Wake County Property Tax Rate 2024 Percentage Formula – RALEIGH, N.C. (WTVD) — Homeowners in Wake County may soon have to pay more in property taxes. County commissioners said they expect property values to increase when 2024 revaluations are sent out. . Travis Long tlong@newsobserver.com Home values across Wake County have shot up in the past four years, according to newly released results of the county’s 2024 revaluation. Residential .

Wake County Property Tax Rate 2024 Percentage Formula

Source : www.wake.gov

Wake County, NC Property Tax Calculator SmartAsset

Source : smartasset.com

Revenue Neutral Tax Rate | Wake County Government

Source : www.wake.gov

Wake County Democratic Party (@wakedems) / X

Source : twitter.com

Revaluation FAQ | Wake County Government

Source : www.wake.gov

1 Wake County Public School System Superintendent’s Proposed

Source : www.wcpss.net

Tax Administration updates leaders on Wake County property

Source : www.wake.gov

How to appeal the assessed property value of your Wake County home

Source : www.wral.com

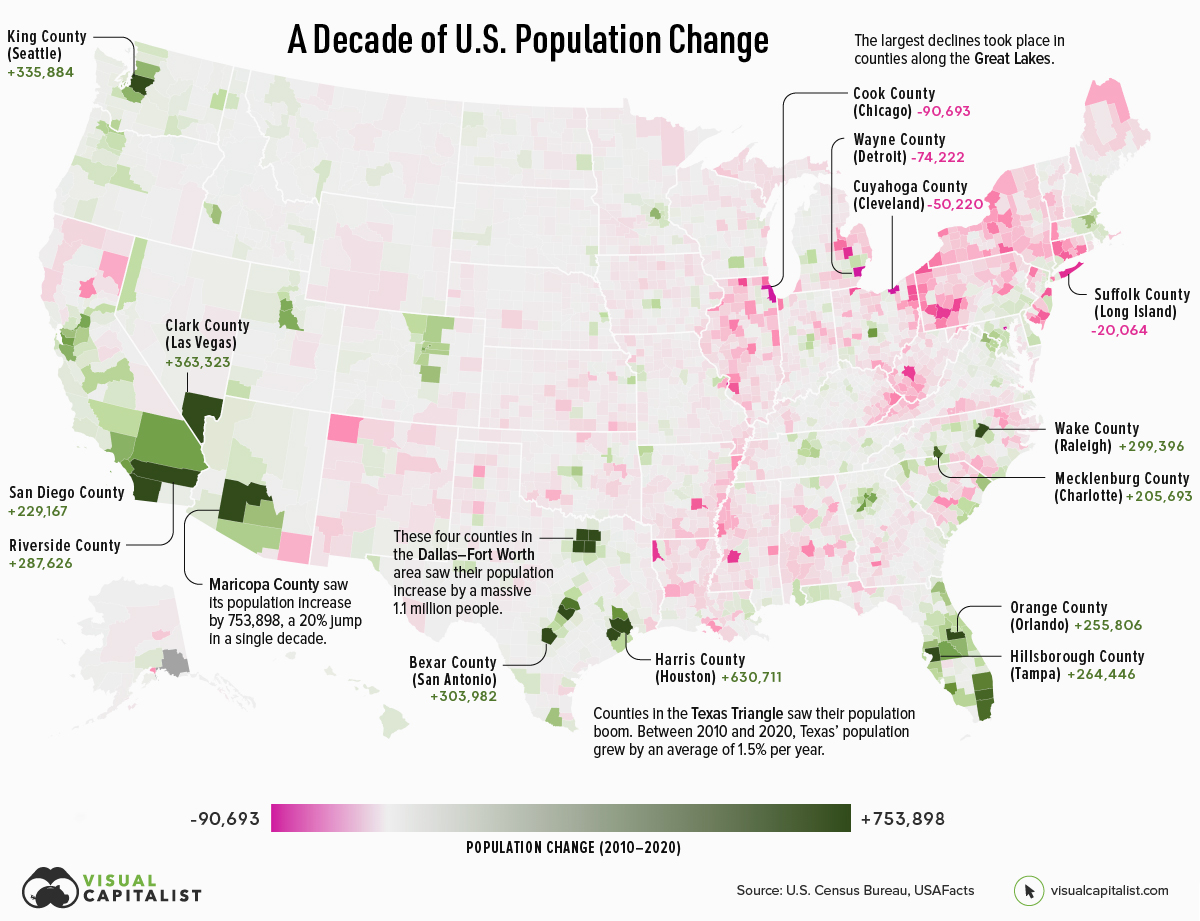

Mapped: A Decade of Population Growth and Decline in U.S. Counties

Source : www.visualcapitalist.com

Sales taxes in the United States Wikipedia

Source : en.wikipedia.org

Wake County Property Tax Rate 2024 Percentage Formula Tax Administration updates leaders on Wake County property : Wake County residential property values are up 53% compared to four years ago, according to revaluation numbers posted Friday by the county. If the proposed revenue-neutral tax rate of $0.4643 per . While it’s very likely Wake County with a $1,176 property tax In 2024, it would be worth $300,000 with a $1,393 property tax In the same time, because of the lowering tax rate, tax bills .